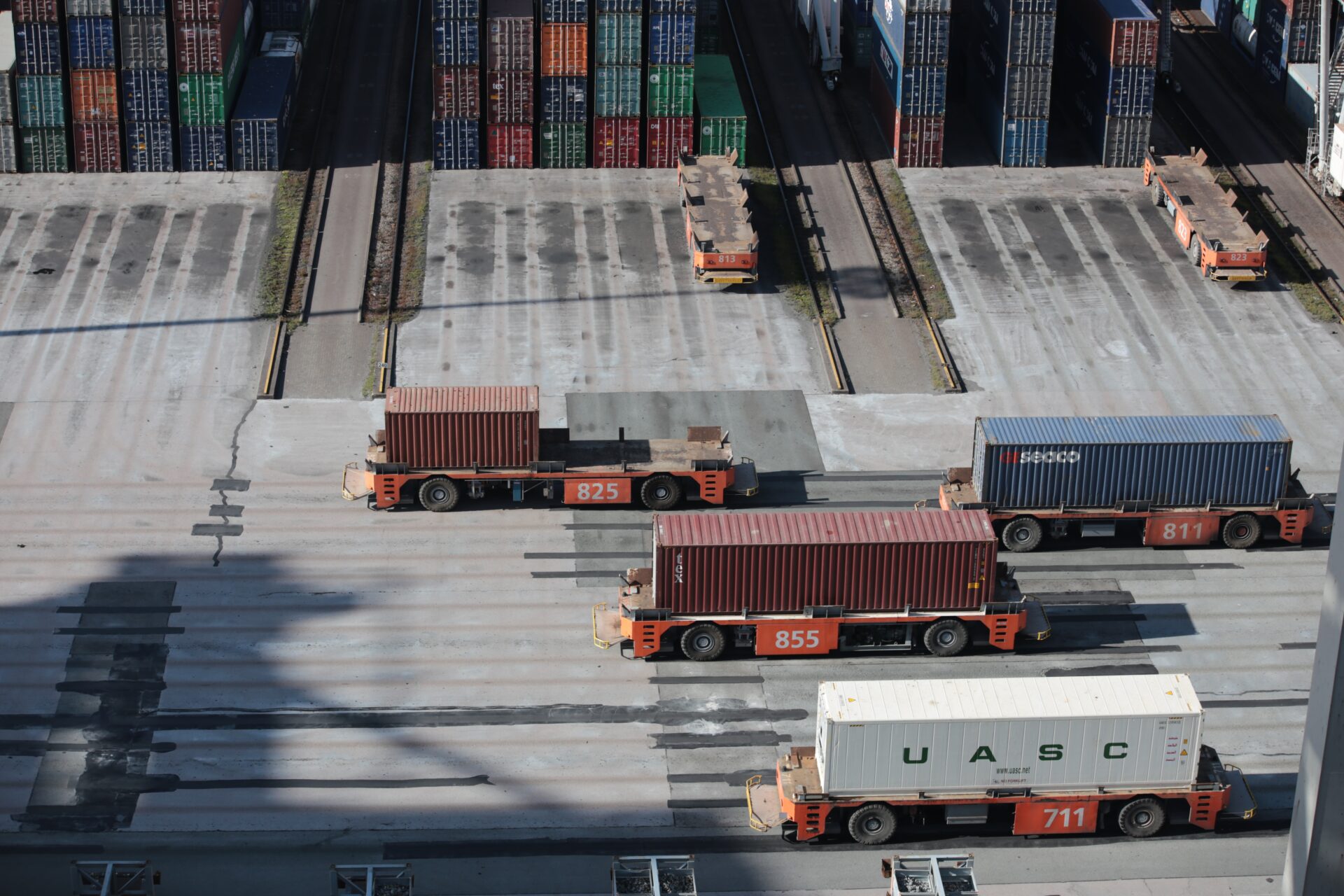

The container shortage problem is no secret and has been circling the market ever since the trading has begun after the Covid-19 lockdown has opened. The problem is not limited to the logistic industry but has also impacted manufacturing, retail business, and trading industries. The cause of container shortage has been a common question ever since we are facing this problem and after a lot of analysis, we have tried to pick the answer to the same.

The major cause of container shortage is Covid – 19. Right, when the lockdown began the on-shore trading market shook down to an immense degree which also affected people working outside, resulting in the reduction of manpower working on the ports. Given limited employees, the speed of managing the payload was furthermore confined. Since various associations stopped their productions, deliveries, and were closed, various compartments stopped operating at the port. The degree of burden was also high with respect to management, which is the explanation for the decrease in conveyance lines and reduced number of boats to adjust the cost. In case the transportation load would have not been sent empty but with a loaded vessel, there wouldn’t have been an unmistakable setback. In like manner, to keep up the ocean freight they expected to diminish the number of vessels. The economic activities were limited and constrained for a moderate period from April 2020 till June and mid-July 2020.

FMC is reliably endeavoring to sort the issues considering a real worry for the US economy by maintaining some significant Shipping Acts. The Washington-set up trading association requested the exploration regarding the issue with utmost concern since this is gigantically affecting the economy, farmers, and agricultural market which are simply facing trading problems over the long halt. The World’s greatest container association A.P. Moeller-Maersk is demonstrating full support with FMC in settling the rising issue.

There have been reports which highlight the issues looked by US exporters of cotton, soybeans, wood, and roughage, communicating that they can’t find any compartments for exchange from the Asian countries while the transportation associations are involved in unloading the containers bringing from Asia and sending them back without stacking them with the American export goods. Taking everything into account there have been high demands of retailers to convey the product which have been depleted during the pandemic while the shortage of containers has made their trade difficult.

After a lot of analysis and statistics the reasons for the shortage of containers that we understood have been:

Due to Coronavirus, the economic activities slowed down to a massive extent which caused an imbalance in trading between American and Asian companies. During the lockdown period, the trading was on the minimum markup, while after July demand for goods recovered at an exponential rate.

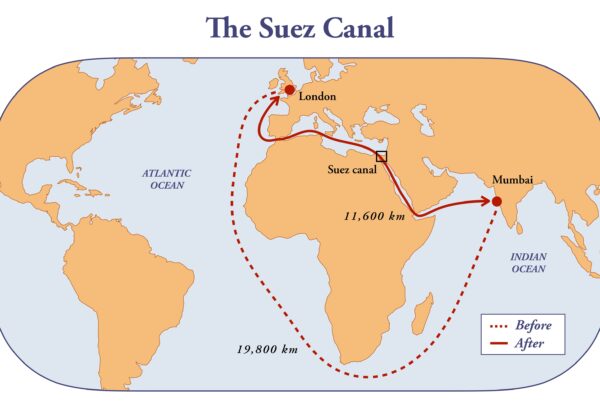

China recovered from coronavirus quicker than other countries and due to government funding started trading, which increased exports from the source. Since China exports electronics, apparel, and other high-value items while US markets heavily export agricultural products. This creates a heavy imbalance between the range and container requirements. This caused a reduction in transportation of the empty container.

China also has an advantage in market requirements as North America has a large demand for products during Christmas. To satisfy the demand China increased the exportation which also oiled the shortage of containers to a higher level.

The severe space problem over the past few weeks was the result of increased demand, reduced imports, and port rotation issues.

Covid-19 lockdown created the idling of vessels which they have re-routed to more profitable trades on the transpacific, leading to supply and demand gaps for major intra-Asia trading routes.

Due to a lack of containerships calling at Indian ports, many carriers have cut short their container lease positions, which has created a shortage and led to additional costs and time to reposition boxes.

There’s a waiting period of three to four weeks at many transshipment ports resulted in congestion and rate increase.

Such a large increase in freight rates impacting the competitiveness of Indian exporters.

Read More: https://www.bdginternational.com/logistics-trade-compliance-news/

Read Asia News: https://www.bdginternational.in/logistics-trade-compliance-news/