The Marine world is on its knees right now. War Risk Insurance is skyrocketing and there are so many factors that it’s hard to determine what information is the most relevant. We have done our best to provide you with the correct and important data so you can understand a bit of Marine insurance history, the implications of Breach insurance and how this all affects the world.

We have also asked our veteran Insurance agent to write something from his perspective. That document is attached and is quite the read. Cargo Coverage During War Insured or Not?

History: Where do wartime insurance policies originate?

It is widely believed that Maritime insurance is the oldest form of insurance dating back to nearly 1200 BC. As transportation became more organized, meaning more cargo or risk was kept in one place, the policies required greater formality as well. The modern maritime insurance we know and love is recorded as originating in Genoa sometime during the 1400s. These first policies focused on cargo and were pretty basic. It wasn’t until a hundred years after Lloyds of London started their empire in a small coffee shop on tower street that the first wartime policy was underwritten. The year was 1779 and without any endorsements or riders this new policy covered fifteen marine perils; eleven directly involved war, piracy, or violence of some kind while at sea. Since then the nuances of these policies and the insurance companies complex algorithmic risk assessment processes have evolved.

“Yearly” vs “Breach” Premiums: Knowing the difference.

First it is important to understand how insurance functions:

The insured has assets worth X amount and needs coverage for A, B, C perils. Based on a number of factors the insurer comes up with an appropriate premium for those assets based on how likely it is that those perils occur. If they occur the insurer has an adjuster that will determine the legitimacy and severity of the damage. If the loss is covered the insurance company indemnifies (pays) the owner.

Yearly insurance is your standard policy whether it’s just a basic form or packed full of endorsements. These policies cover anything listed within the policy and don’t cover anything listed as an exclusion. For something as large as a vessel worth $150,000,000 not to mention the billions in cargo on board it’s safe to say that the policies are extensive.

Due to the value of these assets, certain forms within the yearly policy limit coverage during times of war and usually require notice from the insurer to the insured that they will be changing coverage which may include limitations and or price increase to cover the new risk. This is where the term breach comes into play. During a time of heightened conflict whether that be war, piracy, etc. the location may be categorized as a war breach zone. If that happens it means that the risk of incurring a loss due to the transporting of goods through that location has surpassed the current coverage and an endorsement must be underwritten for that unique situation. These endorsements include what are known as Breach Premiums.

Premium Calculations: How they’re determined

To understand exactly how insurance companies develop their algorithms would take a lifetime. Luckily for breach premiums they keep it clean and simple. It is based on a percentage of the value of the hull and last for a 7-10 day period.

Premium Increases for ocean line risk: Understanding the surge

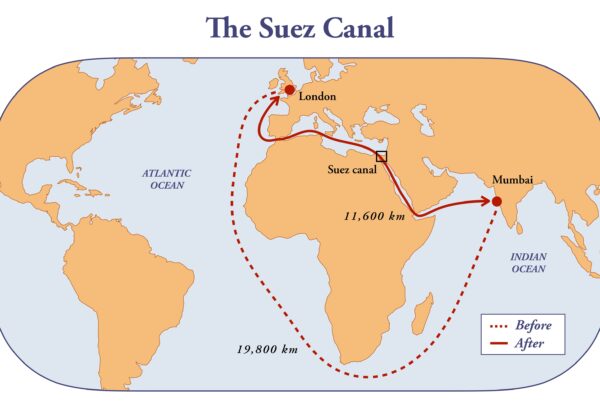

As of late, the big-ticket item in the world of insurance has been the Red Sea Conflict. With 4 out of 5 of the leading freightliners rerouting all cargo from the Suez Canal until further notice it’s clear this is a serious problem, and the war risk insurance reflects that.

Premiums for major ocean liners soared .7% to 1%. A drastic increase forcing many companies to reconsider transport through the Suez Canal. With north of 30 ships being attacked by the Houthi it’s obvious why premiums are rising.

Affected Parties: Who’s shouldering the burden?

Let’s take a look at the overarching numbers first. If a hull is valued at $100,000,000 and travels through the Suez Canal 9 times a year, you’re looking at an additional $2,700,000 yearly expense for that one vessel. A company like Maersk would spend hundreds of millions due to these increases.

A company like Maersk, may not accept that burden themselves. The trickle-down effect occurs and all of sudden cargo owners’ costs increase, not to mention marine cargo insurance purchased has inflated. With the cargo costs increasing the trickle-down effect happens yet again and consumer goods rates will see the results. Even if ocean liners decide to reroute around Africa, the duration of time and expenses will also increase. .

Duration: Predicting the longevity of these trends

After scouring a number of articles, it is completely unclear how long this crisis could last. It seems that the hope is just a few more months but there is no telling. Other sources say that without drastic action it could last years.

Here at BDG, we take the time and care to find you the right coverage. Our specialty insurance protects you and your cargo from all angles ensuring that no matter what happens you always come out on top!

Schedule a no obligation consultation with our solutions team to explore our competitive coverage options!

- https://www.atlas-mag.net/en/article/history-of-war-risks-insurance#:~:text=Lloyd’s%2C%20a%20historical%20player%20in,violence%20on%20the%20high%20seas.

- https://riskandinsurance.com/brief-history-marine-insurance/#:~:text=It%20is%20a%20widely%20held,Mediterranean%20began%20around%201200%20BC.

- https://riskandinsurance.com/brief-history-marine-insurance/#:~:text=It%20is%20a%20widely%20held,Mediterranean%20began%20around%201200%20BC.

- https://logistiq.com/the-origin-of-the-ocean-cargo-policy/#:~:text=True%20maritime%20insurance%20was%20invented,estimating%20risk%20to%20calculate%20rates.

- https://www.lloyds.com/about-lloyds/history/coffee-and-commerce

- https://commercial.allianz.com/news-and-insights/expert-risk-articles/war-insurance.html